USDCHF – Can US Dollar Sellers Continue Current Momentum?

Key Highlights

- US Dollar recently struggled against the Swiss Franc, and it looks like sellers have an upper hand at the moment.

- There is a major bullish trend line formed on the 4-hours chart of USDCHF, which remains at a risk due to the recent downside move.

- Today, the US Consumer Price Index figure will be published by the US Bureau of Labor Statistics.

- The forecast is slated for a minor increase of 0.1% in August 2016, compared with the preceding month.

USDCHF Technical Analysis

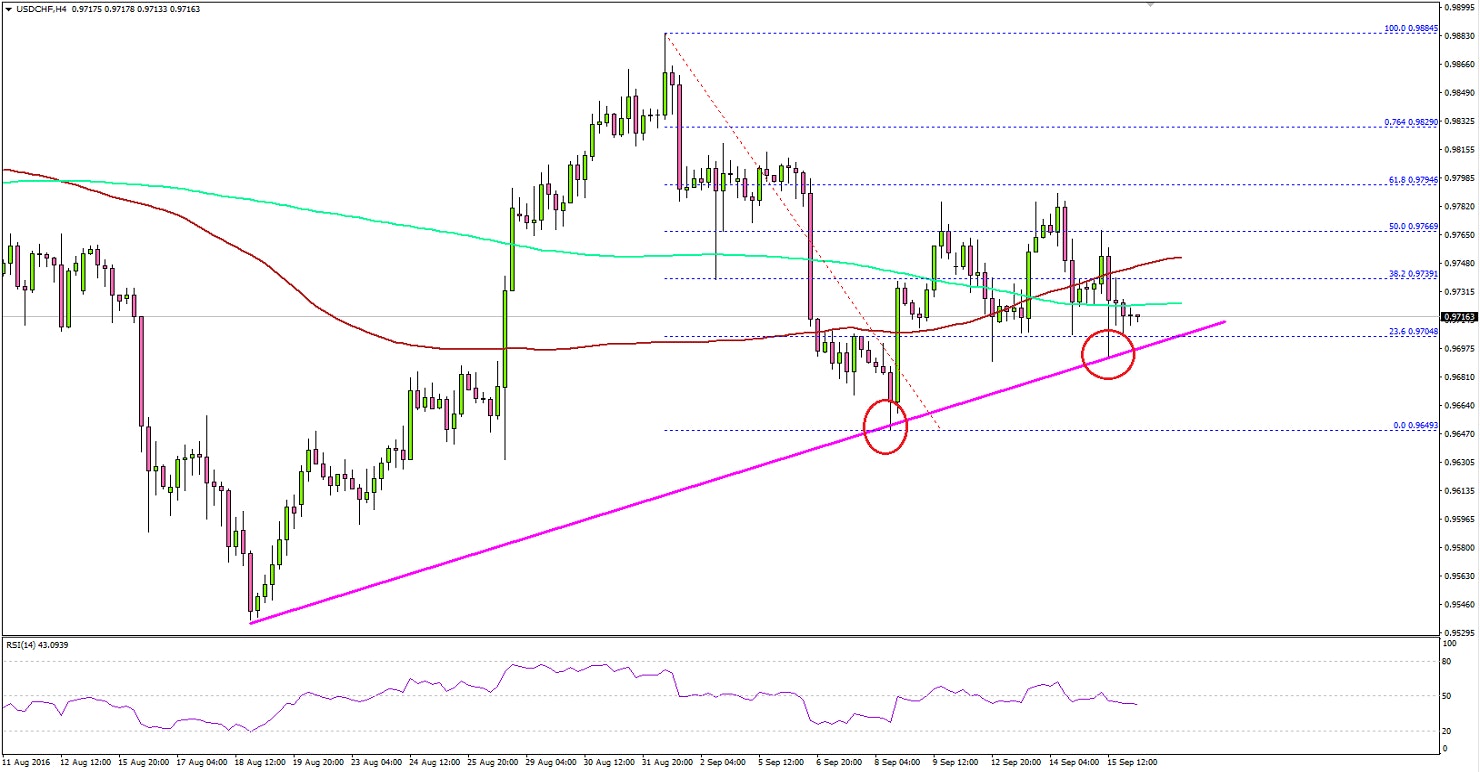

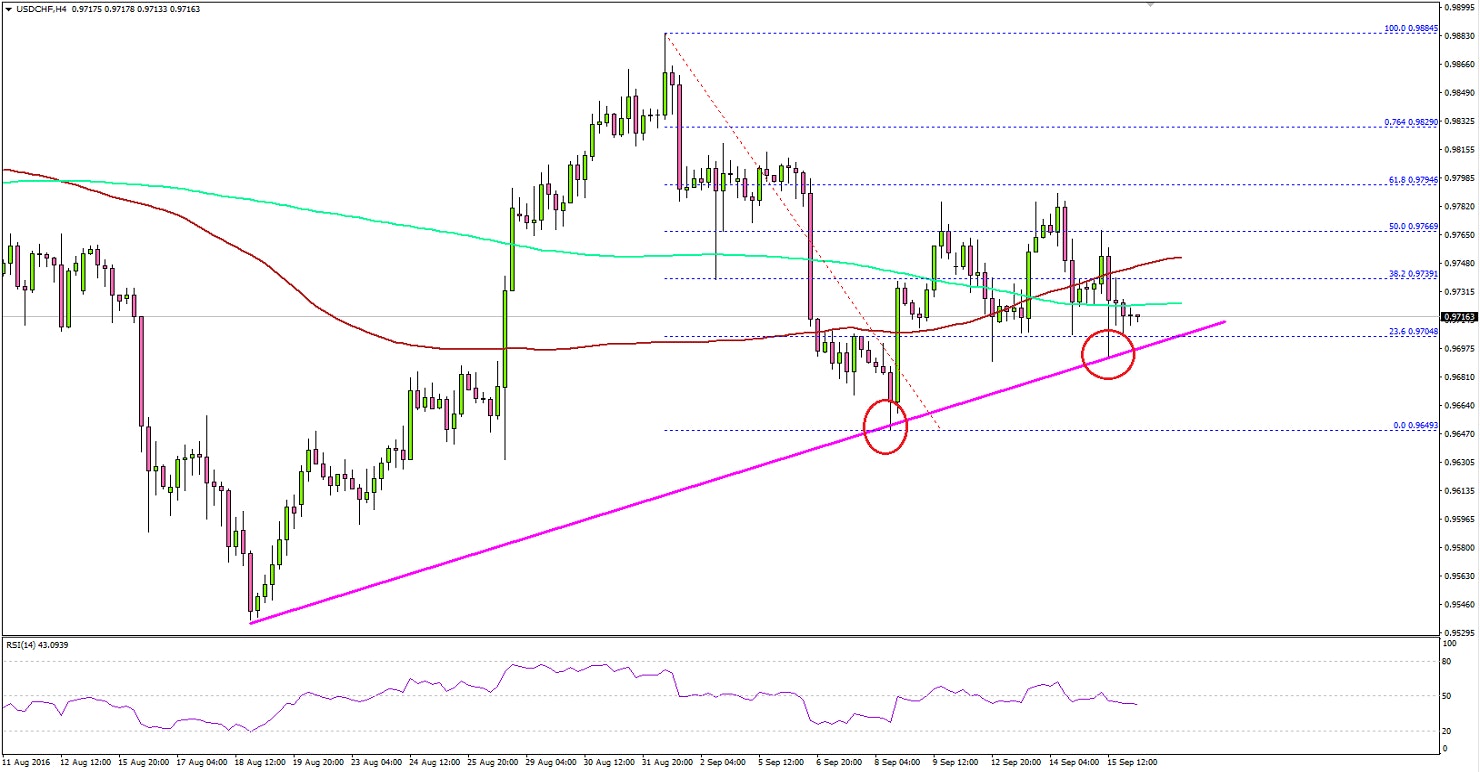

The US Dollar jaw dropped from the high of 0.9884 against the Swiss Franc to test the 0.9650 support. The USDCHF pair is

currently recovering, but can the greenback manage to sustain a comeback?

The main reason why the USDCHF pair managed to hold the downside move was the bullish trend line formed on the 4-hours chart.The highlighted trend line support holds the key for the pair in the near term. A break below it could put sellers more in control.

US Industrial Production

Recently, the US saw the Industrial Production report by the released by the Board of Governors of the Federal Reserve. The forecast was lined up for a decline of 0.3% in the volume of production of US industries such as factories and manufacturing in August 2016, compared with the previous month.However, the outcome was negative, as there was a decline of 0.4% in August 2016. It weighed on the US Dollar and ignited a minor downside move.

US CPI

Today during the NY session, the US will witness a major economic release. The Consumer Price Index figure will be reported by the US Bureau of Labor Statistics. The forecast is slated for a rise of 0.1% in the price movements by the comparison between the retail prices of a representative shopping basket of goods and services.In terms of the yearly change, the US CPI is forecasted to increase by 1%. We need to see whether the CPI data meet the market forecast or not. Any decline in the CPI during the last month may put a lot of pressure on the US Dollar since it may weigh on the decision of the Fed rate hike.

The main reason why the USDCHF pair managed to hold the downside move was the bullish trend line formed on the 4-hours chart.The highlighted trend line support holds the key for the pair in the near term. A break below it could put sellers more in control.

The main reason why the USDCHF pair managed to hold the downside move was the bullish trend line formed on the 4-hours chart.The highlighted trend line support holds the key for the pair in the near term. A break below it could put sellers more in control.