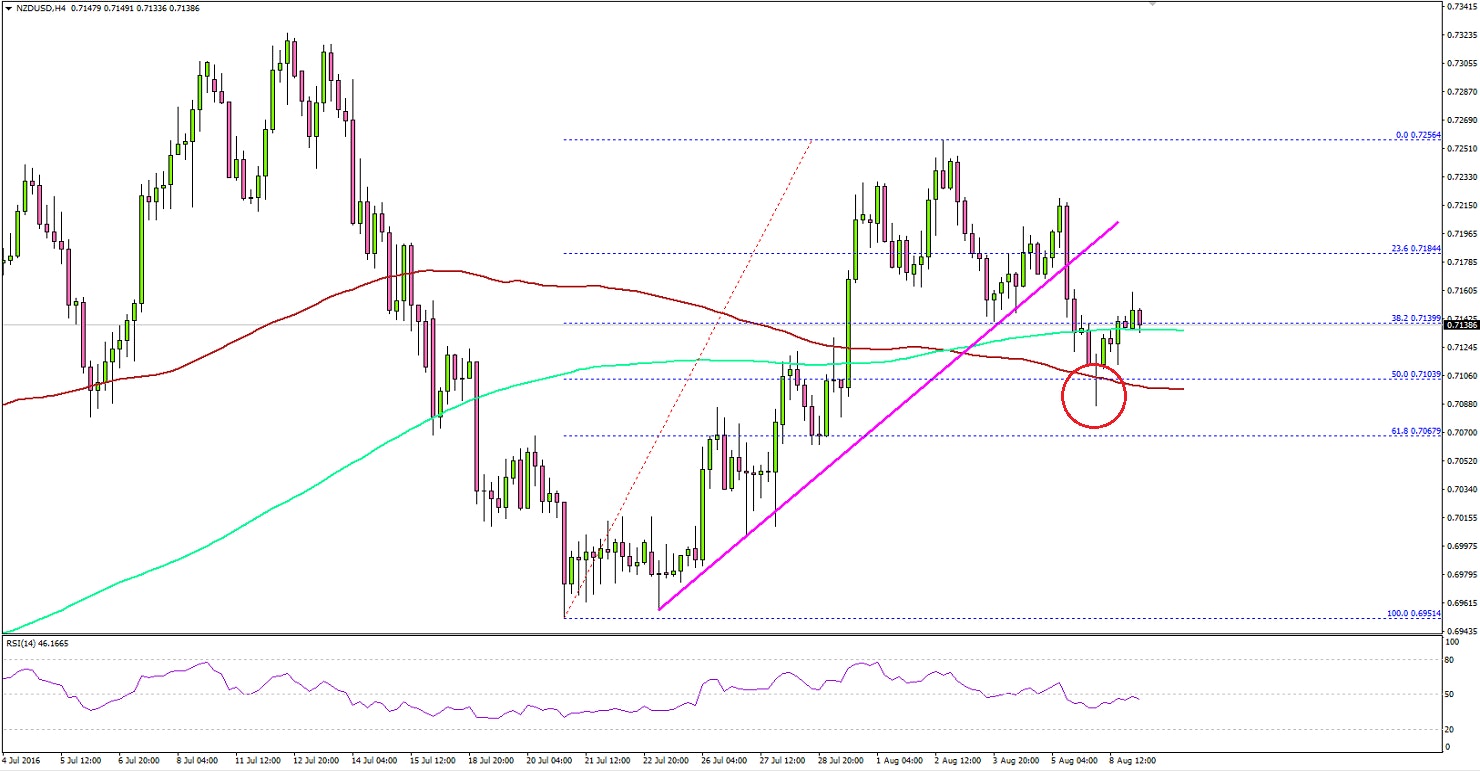

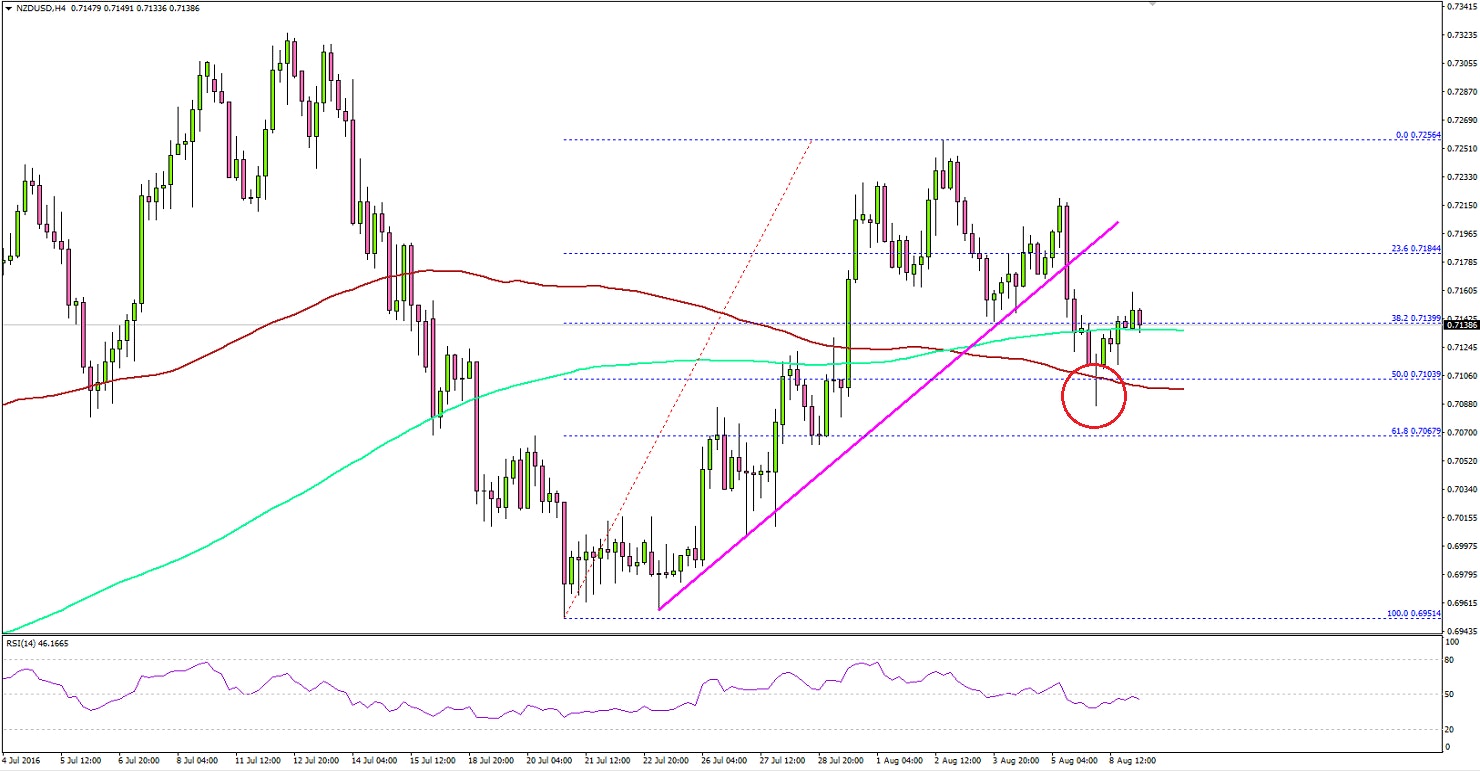

NZDUSD - Next Leg Lower Underway For Kiwi Dollar?

Key Highlights

- The New Zealand dollar after trading above 0.7250 against the US Dollar found sellers and moved down.

- The NZDUSD pair during the downside move broke a major bullish trend line formed on the 4-hours chart.

- The New Zealand Electronic Card Retail Sales as reported by Statistics New Zealand posted a rise of 0.3% in July 2016, compared with the previous month.

- Today in the US, the NFIB Business Optimism Index will be released by the NFIB Research Foundation.

NZDUSD Technical Analysis

The New Zealand dollar after trading as low as 0.7070 against the US dollar (post NFP decline) recovered and currently the NZDUSD pair is

attempting to regain 0.7150.

During the downside move, the pair broke a major bullish trend line formed on the 4-hours chart, which may now act as a resistance. However, the 100 simple moving average on the downside is acting as a support area and stalling losses.As long as the pair is above the 0.7100 support area there are chances of a recovery else there may be a leg lower soon.

New Zealand Electronic Card Retail Sales

Today in New Zealand, the New Zealand Electronic Card Retail Sales, which measures purchases made in New Zealand on debit, credit and store cards was reported by Statistics New Zealand.The forecast was slated for an increase of more than 1% in July 2016, compared with the previous month. However, the result was on the lower side, as there was a rise of 0.3%. In terms of the yearly change, there was an increase of 5.8%.The report added that “Total retail spending using electronic cards was $4.8 billion in July 2016, up $267 million (5.8 percent) from July 2015. The largest increase was in the hospitality industry, up $139 million (18 percent), while the only decrease was in the fuel industry, down $54 million (8.6 percent)”.

NFIB Business Optimism Index

Today in the US, the NFIB Business Optimism Index, which represents the Small Business Economic Trends data will be released by the NFIB Research Foundation.The forecast is slated for no change from the last reading of 94.5 in July 2016. If there is a rise in the NFIB Business Optimism Index, then the US Dollar may gain in the near term.

During the downside move, the pair broke a major bullish trend line formed on the 4-hours chart, which may now act as a resistance. However, the 100 simple moving average on the downside is acting as a support area and stalling losses.As long as the pair is above the 0.7100 support area there are chances of a recovery else there may be a leg lower soon.

During the downside move, the pair broke a major bullish trend line formed on the 4-hours chart, which may now act as a resistance. However, the 100 simple moving average on the downside is acting as a support area and stalling losses.As long as the pair is above the 0.7100 support area there are chances of a recovery else there may be a leg lower soon.