Key Highlights

- The US dollar gained heavily after the recent comments from the Fed Chairwoman Janet Yellen.

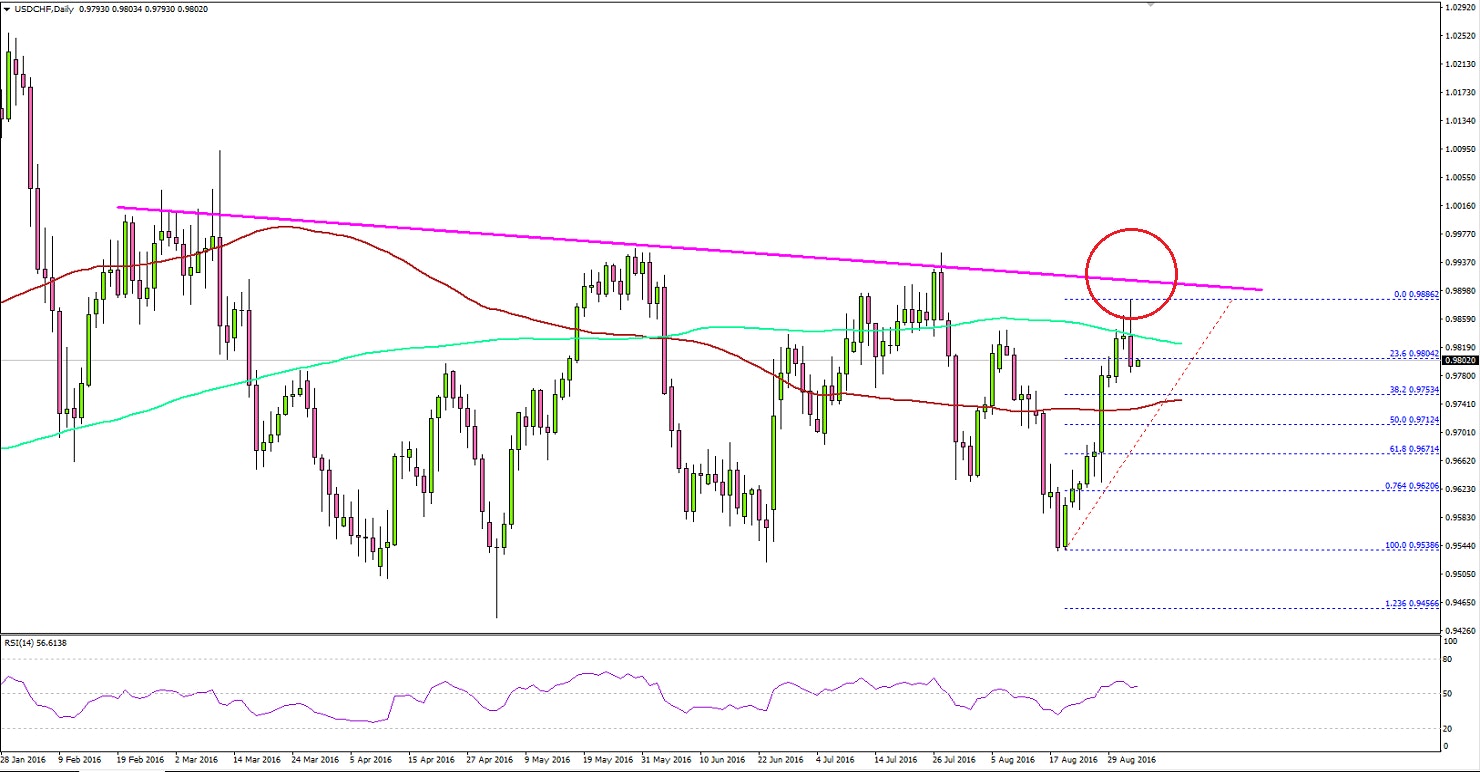

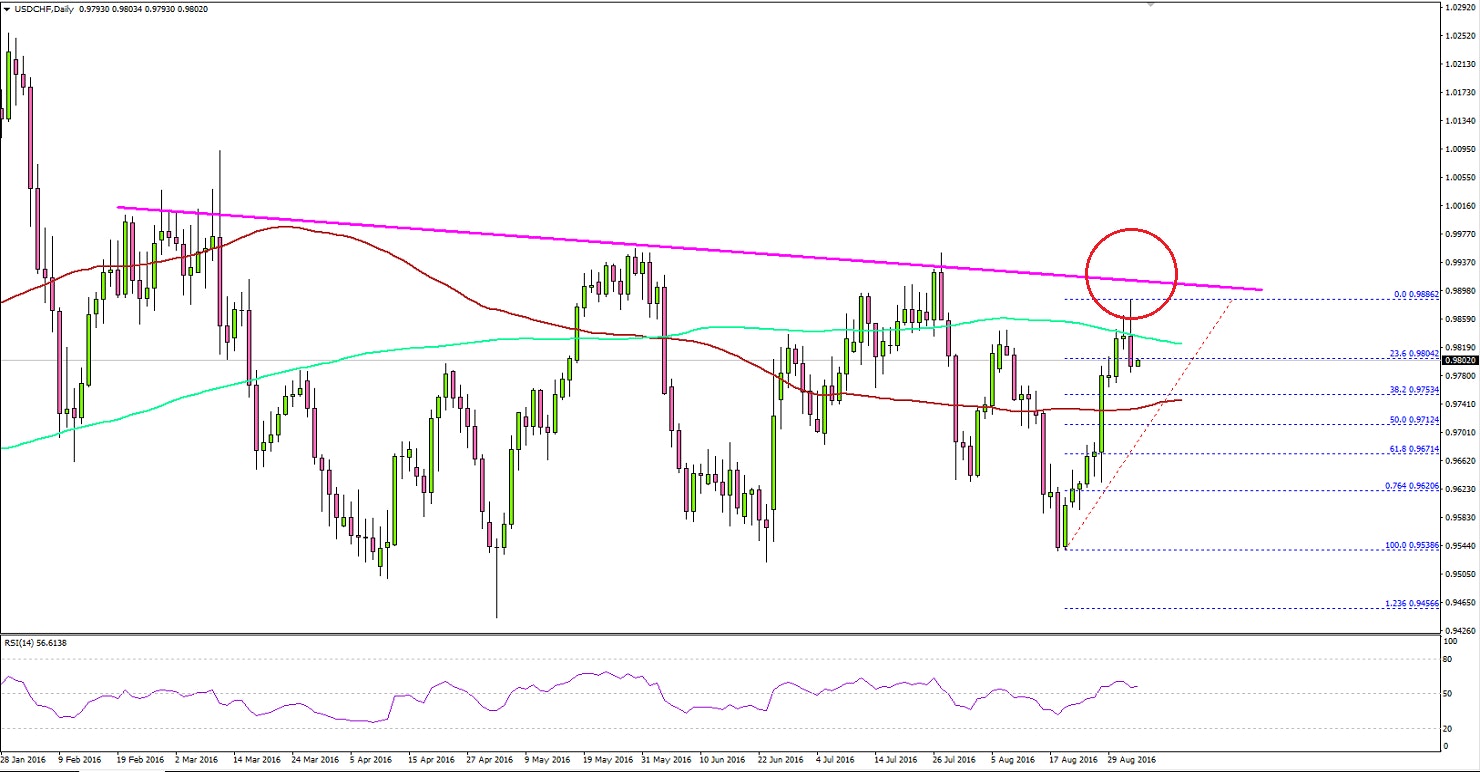

- The USDCHF pair is trading higher and currently heading towards a major bearish trend line on the daily chart.

- Today in the US, the nonfarm payrolls report will be released by the US Department of Labor.

- The forecast is slated for a rise of 180K in August 2016, down from the last gain of 255K.

USDCHF Pair Technical Analysis

The US Dollar surged higher recently and traded above the 0.9800 level against the Swiss Franc. There was a close above the 100-day simple moving average in USDCHF, which could ignite more gains.

On the upside, there is a

monster resistance trend line waiting on the daily chart. It acted as a major hurdle earlier and may prevent an upside move this time.However, if the US Dollar continues to gain momentum, then the trend line may be tested and could be breached as well in the near term.

US NFP

Today in the US, there is a monster release lined up. The nonfarm payrolls, which presents the number of new jobs created during the previous month, in all non-agricultural business will be released by the US Department of Labor.The market is expecting the US NFP to come in at 180K in August 2016, down from the last gain of 255K. The second thing is that the Unemployment Rate, which is a percentage that surges from dividing the number of unemployed workers by the total civilian labor force is expected to decrease from 4.9% to 4.8%.We need to see whether the actual results exceeds or meets the forecast. If it did meet the forecast, then the US Dollar may gain further bids in the near term. The USDCHF pair could even break the resistance area and climb higher.

Japanese Monetary Base

Today in Japan, the Monetary Base, which is the currency supplied by the BoJ including all the JPY in circulation, encompassing notes and coins as well as money held in bank accounts was released by the Bank of Japan. The forecast was slated for 23.1% in August 2016.The result was a bit higher, as it came in at 24.2%. However, there was no effect on the Japanese Yen.

On the upside, there is a monster resistance trend line waiting on the daily chart. It acted as a major hurdle earlier and may prevent an upside move this time.However, if the US Dollar continues to gain momentum, then the trend line may be tested and could be breached as well in the near term.

On the upside, there is a monster resistance trend line waiting on the daily chart. It acted as a major hurdle earlier and may prevent an upside move this time.However, if the US Dollar continues to gain momentum, then the trend line may be tested and could be breached as well in the near term.